Offshore Finance Centres: A Strategic Move for Property Defense

Offshore Finance Centres: A Strategic Move for Property Defense

Blog Article

The Influence of Offshore Financing Centres on International Company Operations and Conformity

Offshore Financing Centres (OFCs) have actually become crucial in forming global company procedures, providing unique advantages such as tax obligation optimization and regulative adaptability. The increasing global emphasis on compliance and transparency has introduced a complicated selection of challenges for companies seeking to take advantage of these centres.

Understanding Offshore Finance Centres

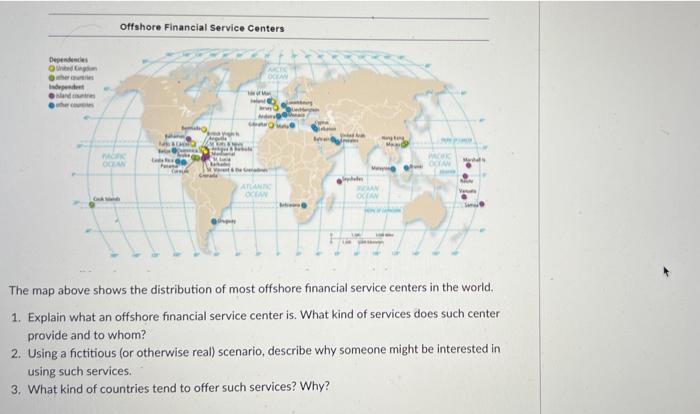

Offshore finance centres (OFCs) work as pivotal hubs in the international economic landscape, assisting in worldwide service deals and investment opportunities. These territories, often characterized by favorable governing settings, tax obligation rewards, and privacy legislations, attract a diverse selection of economic solutions, consisting of insurance coverage, financial investment, and banking monitoring. OFCs allow companies to optimize their economic operations, manage threat more successfully, and accomplish greater adaptability in their monetary strategies.

Usually situated in regions with reduced or no taxes, such as the Caribbean, the Channel Islands, and particular Asian areas, OFCs provide a legal structure that allows business to run with relative convenience. They frequently have durable financial facilities and a solid emphasis on privacy, which interest multinational companies and high-net-worth individuals seeking to secure their assets and get to international markets.

The operational structures of OFCs can differ substantially, affected by neighborhood regulations and worldwide conformity criteria. Understanding the unique attributes of these centres is essential for services aiming to browse the complexities of international financing (offshore finance centres). As the international financial landscape evolves, OFCs remain to play a considerable function in forming the methods of organizations running throughout borders

Benefits of Utilizing OFCs

Using offshore financing centres (OFCs) can substantially boost a firm's economic performance, specifically when it pertains to tax obligation optimization and regulative versatility. One of the primary advantages of OFCs is their ability to offer favorable tax obligation regimes, which can bring about significant financial savings on company tax obligations, funding gains, and estate tax. By purposefully designating revenues to territories with reduced tax rates, companies can boost their total monetary efficiency.

Additionally, OFCs often existing structured regulative atmospheres. This reduced bureaucratic burden can facilitate quicker decision-making and even more active service procedures, allowing companies to respond swiftly to market adjustments. The regulative frameworks in several OFCs are designed to bring in foreign investment, giving companies with a conducive atmosphere for growth and expansion.

Furthermore, OFCs can serve as a strategic base for worldwide operations, making it possible for business to access worldwide markets more successfully. Enhanced discretion steps additionally shield sensitive economic information, which can be critical for maintaining affordable advantages. Overall, using OFCs can develop a more efficient financial structure, sustaining both operational performance and strategic service objectives in a worldwide context.

Obstacles in Compliance

Another significant obstacle is the progressing nature of worldwide guidelines intended at combating tax evasion and money laundering. As federal governments tighten examination and increase reporting needs, businesses must remain active and informed to prevent penalties. This demands recurring investment in conformity resources and training, which can stress functional budget plans, specifically for smaller business.

Additionally, the assumption of OFCs can create reputational dangers. Eventually, organizations should meticulously navigate these difficulties to make certain both compliance and sustainability in their international procedures.

Regulatory Trends Affecting OFCs

Recent regulative fads are significantly improving the landscape of offshore money centres (OFCs), compelling companies to adjust to a progressively rigorous compliance setting. Federal governments and worldwide organizations are executing durable actions to improve openness and combat tax obligation evasion. This change has resulted in the adoption of initiatives such as the Usual Coverage Criterion (CRS) and the Foreign Account Tax Obligation Compliance Act (FATCA), which require OFCs to report financial information about international account holders to their home territories.

As conformity costs increase and regulatory scrutiny magnifies, businesses utilizing OFCs have to navigate these changes meticulously. Failure to adapt could result in severe penalties and reputational damage, highlighting the relevance of positive conformity methods in the progressing landscape of offshore financing.

Future of Offshore Finance Centres

The future of offshore money centres (OFCs) is positioned for considerable improvement as developing regulative landscapes and shifting global economic characteristics improve their function in international company. Enhancing pressure for transparency and conformity will certainly test standard OFC versions, triggering a shift towards higher responsibility and adherence to global standards.

The adoption of electronic modern technologies, consisting of blockchain and expert system, is expected to redefine just how OFCs run. These innovations may enhance functional performance read more and boost conformity devices, permitting OFCs to supply even more clear and safe services. In addition, as worldwide investors look for jurisdictions that focus on sustainability and company social obligation, OFCs will certainly need to adjust by accepting sustainable finance concepts.

In feedback to these fads, some OFCs are expanding their solution offerings, moving beyond tax obligation optimization to include wealth administration, fintech options, and advisory services that straighten with global finest practices. As OFCs progress, they have to balance the requirement for affordable benefits with the necessity to adapt to tightening up policies. This twin focus will eventually establish their sustainability and relevance in the here are the findings global business landscape, guaranteeing they stay integral to global monetary procedures while likewise being liable business citizens.

Final Thought

The influence of Offshore Finance Centres on international organization procedures is profound, offering countless advantages such as tax efficiencies and structured processes. As global criteria advance, the functional landscape for businesses making use of OFCs is altering, necessitating a strategic strategy to make sure adherence.

Offshore Financing Centres (OFCs) have come to be essential in shaping global company operations, offering one-of-a-kind benefits such as tax obligation optimization and regulative versatility.Offshore finance centres (OFCs) offer as critical hubs in the international economic landscape, promoting worldwide business transactions and financial investment possibilities. Generally, the use of OFCs can develop a much more efficient economic structure, sustaining both operational efficiency and calculated business purposes in a worldwide context.

Navigating the intricacies of compliance in overseas finance centres (OFCs) offers significant obstacles for companies.Current regulatory patterns are substantially reshaping the landscape of overseas financing centres (OFCs), compelling services to adapt to a significantly rigid conformity atmosphere.

Report this page